Chinese debt (what we know of the larger picture)

Reuters had a great article today here. China has a habit of “giving” local governments unfunded mandates. This absolves the national government of responsibility for funding certain goals, or if something goes wrong, they can blame local officials.

As local governments become “tapped out” on debt, the situation risks those governments defaulting. This problem is only going to get worse due to China’s demographic and economic problems. In order to try to avoid this outcome, the central government is forcing “state-owned banks to roll over existing local government debt with longer-term loans at lower interest rates”.

“Loans that were due in 2024 or before will be categorized as "normal" instead of non-performing if they overdue”

“To ensure banks do not incur heavy losses from the debt restructuring, interest rates on rolled over loans should not be below China's Treasury bond rates, said one source, adding that loan terms should not exceed 10 years. China's benchmark 10-year government bond is now yielding around 2.7%, while the benchmark one-year loan prime rate is 3.45%.”

"The borrowing costs of LGFVs' loans are usually about 4%, and in some regions and cases the costs could be even higher at about 5% to 8%"

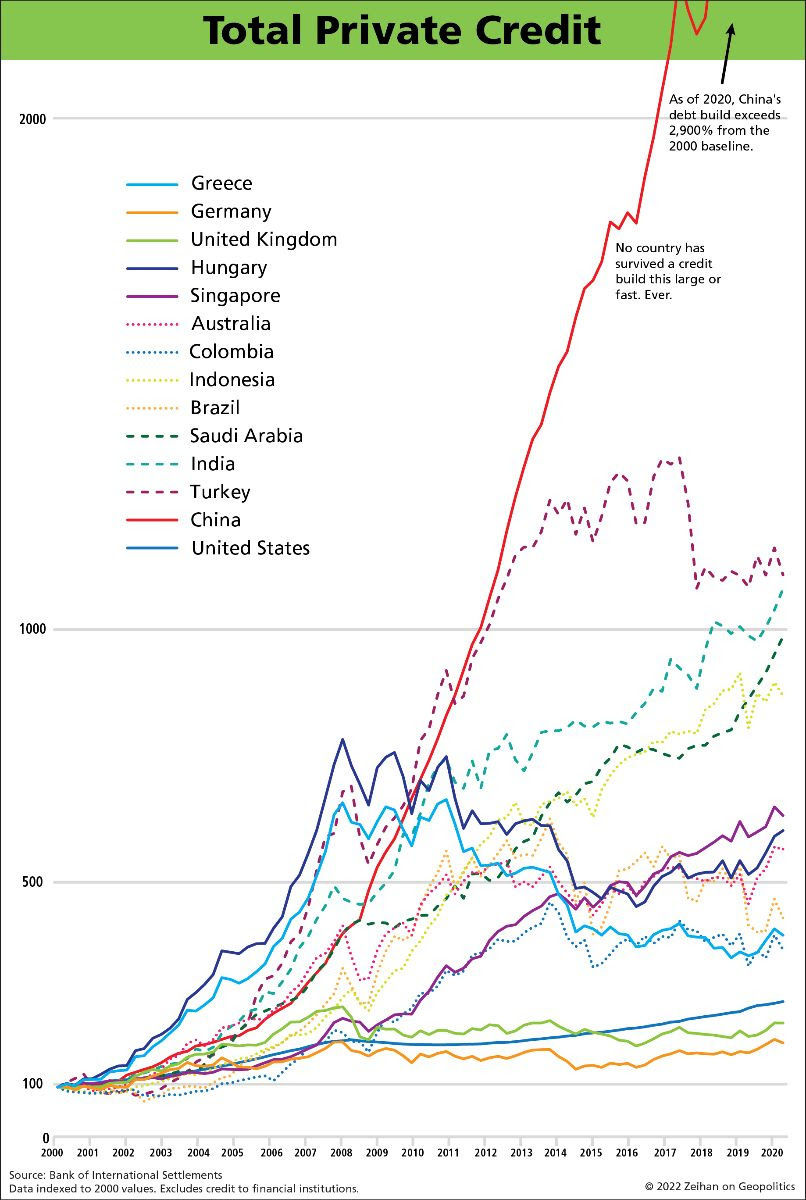

This means that state owned banks are going to be seriously weakened by this, putting them in a much much more precarious financial position. But this is just government debt. Take a look at the following graph (from 2020 when the debt situation was under much better control):

At the same time that this debt overload is happening, China’s economy is slowing and its GDP growth rate is probably overstated by at least 2%. They are also dependent on a globalized system that is rapidly deglobalizing. In addition to this, China is struggling with deflation, so it can’t inflate away the debt.

As if all of that is not enough, Chinese demographics are also weighing on the entire situation.

AND… This is just the debt we KNOW about. The reality of China is that much goes on and is going on that we just don’t know the extent of. Due to corruption, inaccurate reporting, or no reporting at all, we only have a limited understanding of China’s actual economic and debt situation. Best case scenario, it is atrocious. Worst case scenario, it is eventually going to explode and take out the global economy.

“Hiroshi Watanabe, Japan's former top currency diplomat, recalls how Chinese policymakers eagerly studied ways to avert a Japan-style burst of an asset bubble that led to prolonged deflation and economic stagnation - until around 2015.

"Then they stopped. In the past seven to eight years, they seem to be ignoring everything they learned," said Watanabe, who retains close ties with incumbent policymakers. "Under the Xi administration, China probably shifted its attention away from economics," he told Reuters.”

Xi has never had a history of making good economic decisions, and his recent history shows he hasn’t changed his impulses. China from an economic perspective should have been focused on increasing the productivity of their economy. However, this isn’t happening. Instead, the government is nationalizing various industries, or pushing out foreign investors and their capital, and not replacing it with pretty much anything. (As far as we know anyways, and no, Russia doesn’t count).

The concern here is, China pretty much has a few years perhaps 7 - 8 at most, to solidify their position in the Pacific and world stage before they enter terminal decline from a global power perspective. Nations facing a prospect like this either implode, or get aggressive and attack countries in the hopes of solidifying their position further before decline sets in too far. For China, the primary target if they choose the latter course would be Taiwan.

Control of Taiwan gives them control of the first island chain, allows them to strangle Japan’s trade and oil imports, and makes it very difficult for the United States to project power in the western pacific. However, any attempt to conduct a hostile take over of Taiwan would draw the US and its allies into a direct war or confrontation with China, perhaps with unknown consequences.

It would be horrendous for China’s economy as well or for anything attached to it (such as Apple trying to get product out of China to the US during a major war where ships transporting goods would be sunk and/or not insurable).

China (unlike the United States) has to import a large variety of materials to have a modern military and society. Cutting off the Strait of Malacca would strangle China’s military and economy rapidly. That area is not really within the range of the Chinese navy, nor is it near the islands they are building in the South China Sea. Singapore, a key US ally, with a powerful and modern navy, is also there, along with other allied navies.

China could try to utilize their nuclear arsenal in desperation. But this does not guarantee success either. At the moment, China is still building out its arsenal since it is behind Russia and the United States in strike capability.

In the end, China is really in a race against time, but also doesn’t really have the capability to successfully destroy Taiwan militarily without nuclear weapons’ use. If they use nuclear weapons, that would provoke a global response for certain. China could try a complete blockade of Formosa, but that would invite retaliation by the US, Taiwan, and Japan simultaneously.

One thing China could do is try to do a smaller blockade or seizure of outlying islands close to mainland China, while allowing Formosa to go unmolested. Would the US be willing to go to war with China over say, the Matsu islands? Not doing so, could cause not only Taiwan to appear weak, but could also call into question the US’ resolve to help defend Taiwan against further attacks.

On the other hand, if the US retaliated, would other allies join the US? Or would that be seen as a bridge too far?

In addition to all these other factors, the west has started to heavily rearm since Russia’s further invasion of Ukraine. This means the window of opportunity for China is closing even faster.

All of this doesn’t even begin to scratch the surface of China’s many problems. All I can say is… it’s going to be interesting to watch what they decide to do.