Types of risks in bond analysis (a brief introduction)

This will likely be the first in a series of posts

Introduction

This post is going to be one of a series over time on bonds and bond analysis. I’m posting these as I also learn the material from the textbook: “Bond Markets, Analysis and Strategies” Eighth Edition by Frank J. Fabozzi. What you see below is covered in slightly more detail in the book, and it is with gratitude that I give credit for this post to that book. Another excellent book on bonds in general for the lay person is: “Bonds the unbeatable path to secure investment growth” by Hildy & Stan Richelson. What follows is a very brief summary of a much more complex topic. So, keep that in mind.

Bonds hold a unique place in my heart. There are of course, ways of trading bonds to make money, bond funds I am not a big fan of, since often they roll over and/or sell securities, sometimes at a loss. As an individual investor, if you hold a US treasury bond to maturity, your risks of loss are very very low. However, there are potential opportunity costs and other considerations for where that money could have been invested if you had accepted more risk of loss for a greater return elsewhere.

Still, I like bonds, since you know exactly what you paid, and you know what you’ll get and when you’ll get it. (with some important caveats for risk that I’ll talk about below). If you’re more concerned with ‘minimizing the probability you’ll run out of money in retirement’ as opposed to ‘maximizing your return’, then bonds make lot of sense for most folks’ retirement portfolios for at least a portion of their money. Some types of bonds are easy to understand (such as US government treasuries) others have more risks due to various embedded options, so conducting valuation on those bonds is more challenging. Embedded options can include the option of the issuer to call away the bond and reissue another if interest rates fall lower, this is to the detriment of the bond holder, since they would be receiving a lower rate of interest. Conversely, ‘put provisions’ allow the bond holder to sell the bond back to the issuer at face value at certain times.

Those are just two of several different embedded options. But since this is an article on different risks for bond purchasers to consider, I won’t go into more detail than that.

Types of Bond Risks

A basic rundown concisely put of risks with bonds include the following:

Interest-rate risk

Reinvestment risk

Call risk

Credit risk

Inflation risk

Exchange-rate risk

Liquidity risk

Volatility risk

Risk risk (I know, it’s not a typo, and yeah it sounds dumb but it isn’t)

Interest-rate risk is caused by a change in general interest rates. You may have heard the phrase “When interest rates fall, bond prices rise” and vice versa. For some, this can be a little confusing, so here’s a very very simplified example:

Say I pay $1,000 for a 10 year US Treasury bond and that originally yields 5%. The face value is $1,000 and I pay the full $1,000 for the bond.

Original bond price: $1,000 — yield on the bond: 5% — current general interest rates: 5%

Some time passes, let’s say it’s only 2 months. The Federal Reserve then raises rates to 8%

Current market bond price (if sold & not held to maturity): $787 — yield on the bond: 5% — current general interest rates: 8%

This is the nature of interest rate risk. (Keep in mind this is a simple example) Conversely, let’s say that that instead of rising interest rates fell to 2%:

Current market bond price (if sold & not held to maturity): $1,170 — yield on the bond: 5% — current general interest rates: 2%

So, when interest rates rise bond prices fall, and when interest rates fall, bond prices rise. Now you know what that looks like. Fun side note: convexity is essentially the derivative of duration (a little bit of calculus can help here). There is a simplistic calculator under the ‘financial resources’ page to help with showing this. Here

Reinvestment risk is the risk that is assumed in a scenario where coupon payments are reinvested. The interest on your interest could be lower if interest rates fall during the duration in which you hold a bond. The longer the term, the higher the risk.

Call risk - One potential embedded option in some bonds is called a call option. This allows the issuer to “call away” the bond that was issued at a previous higher interest rate, and reissue a bond at a lower rate of interest if general rates drop. Essentially, allowing an easy way for an entity to refinance its debt.

Credit risk - Simply put: default. The risk an issuer of a bond will not meet its obligations under the terms of the debenture. However, this is not the only nature of this risk. All non-treasury bonds typically have a premium paid since there are greater risks for these securities vs a US treasury bond. This premium is called ‘the spread’. The price that a non-treasury bond will fetch on the market can decline if the credit spread widens. This can happen due to a economic, industry-wide, or other factors.

Inflation risk - Non-floating rate bonds that are not linked to inflation have a risk of the rate of inflation increasing beyond the yield of a bond.

Exchange-rate risk - If you own a French bond that is making payments in Euros, and you live in the US and spend in dollars, there is a chance that if the Euro weakens against the dollar, your payments would in effect, be smaller.

Liquidity risk - If a bond cannot be sold near the value paid for it, this encompasses liquidity risk (since it cannot be liquidated for cash). This risk isn’t present for bond holders who intend to hold their bonds to maturity. This risk is present for investors in bond funds, since bond funds periodically roll over their securities. In addition, if you buy a bond fund and then bond prices change, you have liquidity risk if you sell the fund. Since funds have a variety of bonds at any given time with different maturities, you cannot “hold a bond until maturity”.

Volatility risk - If a bond has an embedded option, (in this instance a call option), and interest rates are volatile, the option can become more valuable for the issuer, but less valuable to the bond holder. This can result in the market price of the bond falling.

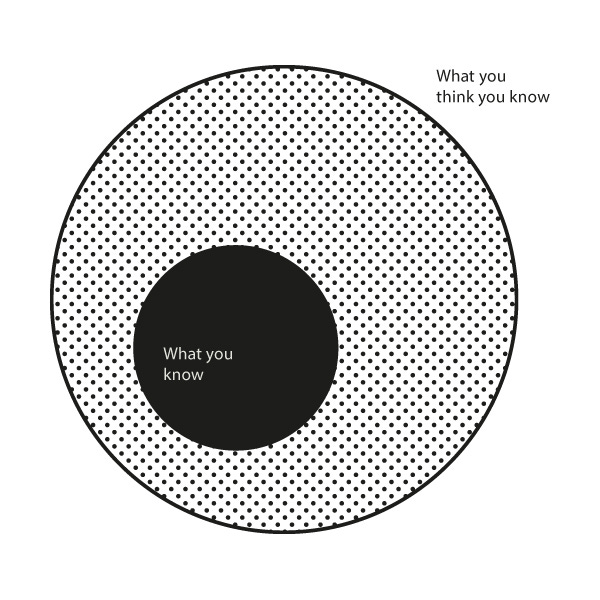

Risk risk (yeah I know) - Remember when Donald Rumsfeld (the former US secretary of defense) said: “There are unknown unknowns”? This risk is of that nature. Basically, especially for newer securities, or securities held by those who don’t understand them, there are risks that you potentially don’t know exist. The Collateralized Debt Obligations (CDOs) that existed prior to the Great Financial Crisis of 2008, had this risk. At that time, even the largest banks’ CEOs and managers did not understand the risk of these instruments. One way of avoiding this type of risk is to simply not invest in things you don’t understand. The danger of assuming you understand the risks you’re taking when you don’t understand the risks, exposes you to “risk risk”. Staying firmly within your circle of competence and not going near the dangerous edges, can save you.